All About Unicorn Finance Services

About Unicorn Finance Services

Table of ContentsThe Single Strategy To Use For Unicorn Finance ServicesAbout Unicorn Finance ServicesWhat Does Unicorn Finance Services Mean?The 3-Minute Rule for Unicorn Finance ServicesThe Of Unicorn Finance ServicesThe Basic Principles Of Unicorn Finance Services

We independently review all suggested items and also services. Mortgage brokers assist would-be consumers find a lender with the best terms and rates to meet their economic demands.

They likewise collect as well as confirm all of the essential paperwork that the lending institution needs from the borrower in order to complete the residence purchase. A home mortgage broker normally functions with various lenders and also can offer a selection of funding choices to the consumer. A consumer doesn't need to deal with a mortgage broker.

Indicators on Unicorn Finance Services You Need To Know

While a home loan broker isn't necessary to help with the deal, some lending institutions might just function through mortgage brokers. If the lender you choose is among those, you'll need to utilize a home mortgage broker.

Mortgage brokers do not give the funds for financings or authorize lending applications. They assist individuals seeking residence loans to locate a lender that can fund their home purchase.

When conference prospective brokers, obtain a feel for exactly how much interest they have in aiding you get the finance you require. Ask about their experience, the exact assistance that they'll give, the fees they bill, and also exactly how they're paid (by lending institution or borrower) - Broker Melbourne.

Unicorn Finance Services Can Be Fun For Everyone

Here are 6 advantages of using a home mortgage broker. Mortgage brokers are extra versatile with their hrs as well as in some cases ready to do after hrs or weekend breaks, conference each time and place that is hassle-free for you. This is a significant advantage for full time workers or households with dedications to think about when intending to find an investment residential or commercial learn this here now property or marketing up as well as going on.

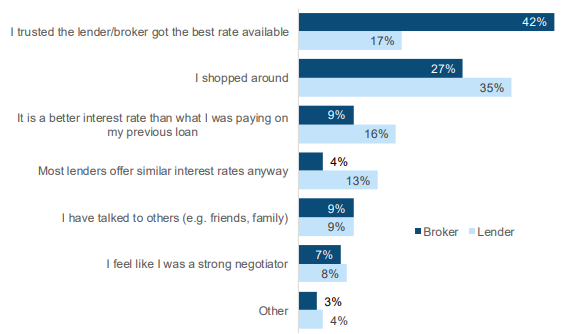

When you meet a mortgage broker, you are properly getting access to multiple banks as well as their finance options whereas a bank just has accessibility to what they are providing which might not be matched to your requirements. As a home capitalist, locate a knowledgeable mortgage broker who is concentrated on supplying home financial investment finance.

Not known Facts About Unicorn Finance Services

This enables it to end up being extremely clear of what your loaning power truly is as well as which lending institutions are the most likely to lend to you. This aids you to recognize which loan providers your application is most likely to be effective with as well as decreases the opportunity that you'll be denied various times and marks versus your credit report.

A lot of brokers (however not all) generate income on compensations paid by the lending institution as well as will solely rely upon this, giving you their services cost-free of fee. Some brokers might make a greater compensation from a certain lender, in which they might be in favour of as well as lead you in the direction of.

A great broker collaborates with you to: Understand your requirements and also goals. Job out what you can afford to obtain. Locate alternatives to fit your situation. Describe just how each finance works and also what it costs (as an example, rate of interest, functions and costs). Apply for a finance and also take care of the process through to settlement.

Little Known Facts About Unicorn Finance Services.

Some brokers get paid a basic charge regardless of what car loan they advise. Various other brokers get a higher cost for using particular loans.

If the broker isn't on one of these listings, they are operating unlawfully. Prior to you see a broker, assume regarding what matters most to you in a home financing.

Make a listing of your: 'must-haves' (can not do without) 'nice-to-haves' (can do without) See picking a house finance for guidance on what to take into consideration. You can locate a licensed home loan broker via: a home mortgage broker specialist association your loan provider or banks suggestions from individuals you know Bring your checklist of must-haves as well as nice-to-haves.

The Greatest Guide To Unicorn Finance Services

Get them to describe how each financing choice works, what it costs and why it remains in your finest rate of interests. You don't have to take the first finance you're supplied. If you are not pleased with any option, ask the broker to locate choices. You may have a preference for a particular lending institution, such as your existing financial institution - https://www.openstreetmap.org/user/Unicorn%20Finance%20Services.